Unlocking the Potential of Your Superannuation: Investing in Property the Smart Way

Your superannuation is more than just a retirement safety net it’s a powerful wealth-building tool. But have you ever considered using it to invest in property? While directly withdrawing your super to buy a property isn’t an option, setting up a Self-Managed Superannuation Fund (SMSF) could open doors to this exciting opportunity. Here’s how you can take control of your super and potentially transform it into a property investment portfolio.

Can You Really Use Super to Buy Property?

The short answer: Yes. Superannuation laws are designed to protect your retirement savings, meaning you can’t access your super early unless you meet strict conditions, like retiring after reaching your preservation age (55 to 60) or facing financial hardship.

That said, SMSFs are a game-changer. With an SMSF, you can pool your super with up to three others (family or trusted members) and invest in assets, including property, under the watchful eye of Australian regulations.

Imagine owning an investment property funded by your super, with rental income growing your retirement nest egg—it’s not just a dream, it’s a regulated reality.

How SMSFs Make Property Investment Possible

An SMSF offers you the freedom to invest in property, but it’s not without rules. Here’s what you need to know:

The Rules of the Game

Purpose-Driven Investing:

The property must benefit your retirement savings, not your personal life.

No personal use—this includes holiday homes or renting to family members at a discount.

Borrowing Made Simple:

SMSFs can borrow to purchase property under a Limited Recourse Borrowing Arrangement (LRBA). This means the loan is secured only by the property, protecting your other SMSF assets.

ATO Compliance is Key:

Your SMSF must follow a robust investment strategy.

Liquidity is crucial—your fund should have enough cash flow to cover ongoing expenses.

Why Choose SMSF Property Investment?

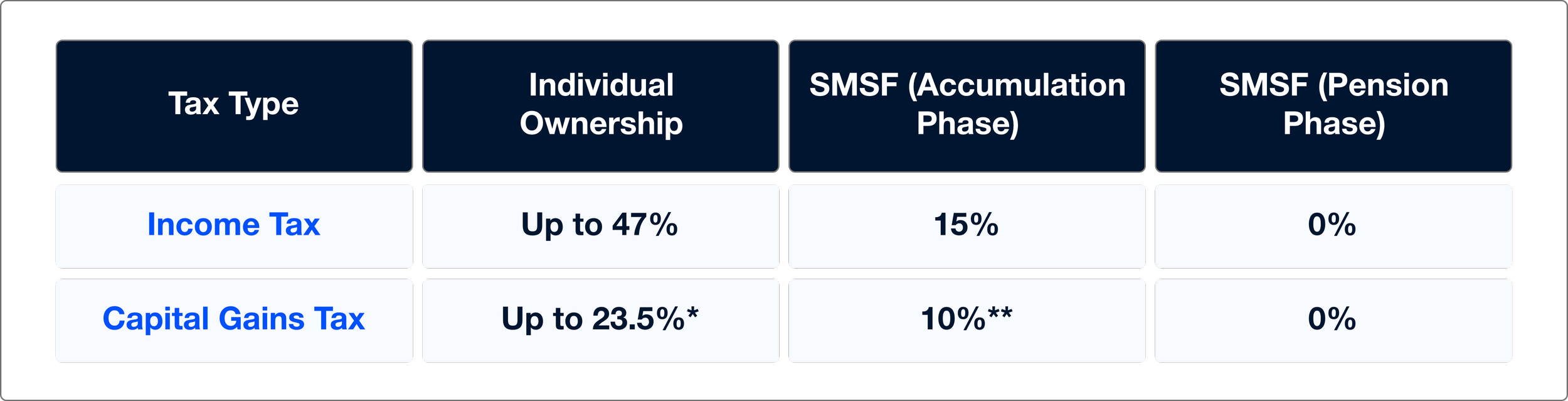

Investing in property through an SMSF isn’t just about diversification—it’s about maximising tax efficiency and creating long-term wealth.

Tax Benefits That Pack a Punch

Individuals benefit from a 50% CGT discount if the asset is held for more than 12 months.

*SMSFs enjoy a one-third CGT discount in the accumulation phase.

Example: Your SMSF purchases a $750,000 property earning $20,000 annually in rental income:

Individual tax: Up to $9,400 per year.

SMSF (Accumulation Phase): $3,000 per year.

SMSF (Pension Phase): $0—yes, tax-free income in retirement!

And the cherry on top? Capital gains realised during the pension phase are completely tax-free.

The Cost of Control: Is It Worth It?

Running an SMSF isn’t without its challenges. Before you dive in, here’s what to keep in mind:

Setup Costs: Expect to pay around $1,650 (inclusive of GST).

Ongoing Management: Annual admin and compliance fees average $3,300.

Time Commitment: Trustees must ensure compliance with strict ATO regulations—this isn’t a “set and forget” strategy.

However, for those with a keen interest in managing their own retirement savings, the benefits often outweigh the effort.

Why Property Investment Through SMSFs Stands Out

Here’s what makes this strategy shine:

Tax Savings: Reduced tax rates during your working years and zero tax in retirement.

Income Stream: Rental income can supplement your super balance.

Control and Transparency: Tailor your investments to align with your goals.

Imagine entering retirement with a steady rental income and a growing portfolio that you built—your way.

Is It Right for You?

SMSFs aren’t a one-size-fits-all solution. They’re best suited to individuals who:

Have a combined super balance of $200,000 or more (to cover costs and maintain liquidity).

Are committed to actively managing their fund and investments.

Have sought professional advice to ensure this strategy aligns with their long-term goals.

Your Next Steps

Thinking of taking the leap? Before you do:

Consult an Expert: Speak to a financial adviser or tax professional to understand your obligations and benefits.

Plan for Compliance: Ensure you have a clear strategy and understand the ATO’s requirements.

Contact Us: At Guidance Accounting, we specialise in helping clients navigate SMSF property investment. Let’s explore how you can make your super work harder for you.

Final Thoughts

Using your super to invest in property through an SMSF is a bold but rewarding strategy. It’s not just about securing your retirement—it’s about growing your wealth while enjoying tax benefits and financial control. With the right guidance, you can turn your vision into reality.

Disclaimer: This blog provides general information and is not a substitute for professional advice. Always consult with a financial adviser or an accountant, such as Guidance Accounting, to discuss your unique circumstances and ensure compliance with Australian regulations. For tailored advice, visit us at https://www.guideacc.com.au/contact-us/.